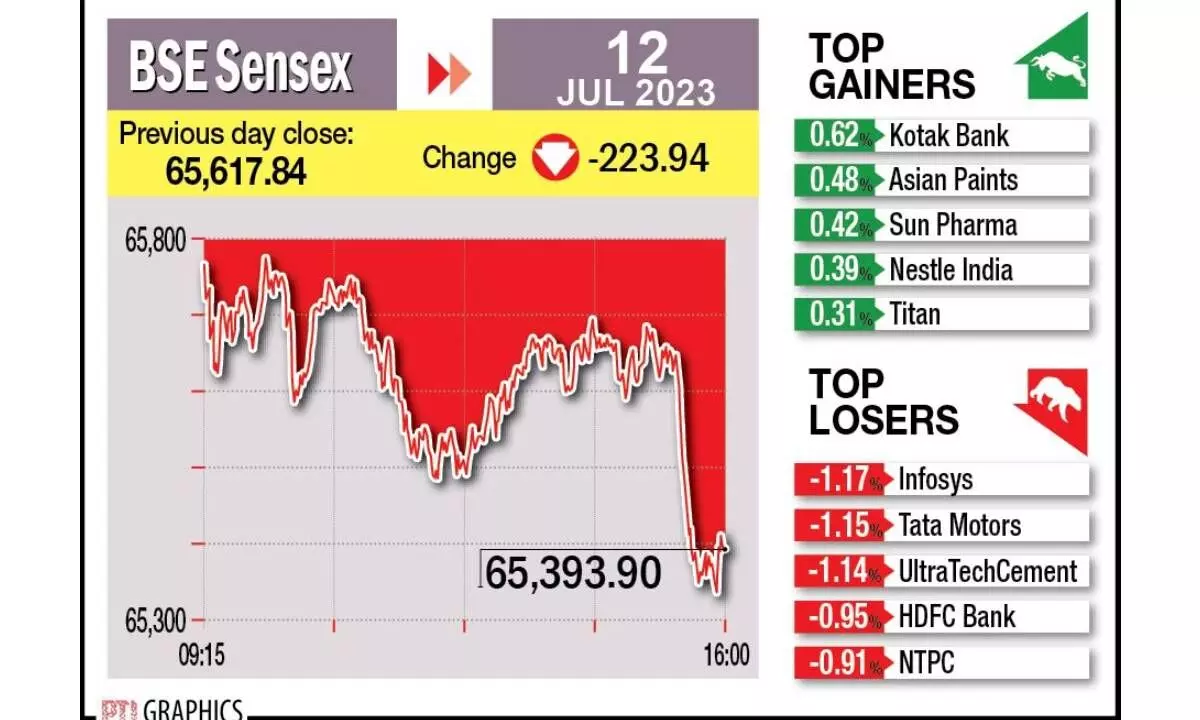

Profit booking snaps 3-day rally

Investors in wait n watch mode ahead of key macroeconomic data and Q1 results from TCS and HCL Technologies

image for illustrative purpose

Mumbai Benchmark equity indices ended lower on Wednesday after three days of gain amid profit-taking ahead of key macroeconomic data announcements as well as the first quarter earnings from TCS and HCL Technologies.

Fag-end selling pulled down the 30-share BSE Sensex lower, which declined 223.94 points or 0.34 per cent to settle at 65,393.90. During the day, it hit a low of 65,320.25 and a high of 65,811.64. The NSE Nifty fell by 55.10 points or 0.28 per cent to end at 19,384.30.

“Markets showed resilience in early trades, but the upward march had been showing signs of fatigue of late and investors today pulled the plug ahead of key domestic inflation data and the US CPI inflation. As the global economy remains under pressure, local markets are likely to witness bouts of profit-taking during such prolonged rallies,” said Shrikant Chouhan, Head of Research (Retail), Kotak Securities Ltd.

“The range-bound movement in the Indian indices was influenced by the likelihood of subdued IT earnings,” said Vinod Nair, head (research) at Geojit Financial Services. Foreign Institutional Investors (FIIs) turned net sellers as they offloaded equities worth Rs 1,242.44 crore on Wednesday, according to exchange data. India’s industrial production rose 5.2 per cent in May, according to the official data released on Wednesday evening. Retail inflation in June rose to a three-month high of 4.81 per cent.